ATM Skimming : Safety Lies In Your Own Hands

In the recent past there has been a rise in the number of banking frauds related to ATM card transactions and fraudsters are using new techniques to rob customers of their savings. While banks are doing their bit in making card transactions safer and are working towards protecting customers from being fleeced, banking experts say that customers need to be extra careful as a large number of cases are a result of negligence on part of the card holder.

While individuals ranging from common citizens to police officials have been robbed of their savings through ATM frauds, here we are discussing about ATM Skimming and how cardholders can protect themselves against such frauds.

ATM Card Skimming & PIN Capturing

This is a more technical mode of duping and the cardholder can hardly do anything about it as the miscreants plant small devices for skimming and pin capturing.

Skimming:

- A method used by criminals to capture data from the card.

- Devices used are smaller than a deck of cards and are often fastened in close proximity to, or over the top of the ATM’s factory-installed card reader.

- The device can read the magnetic tape information of the card when the card goes through the skimming device.

- With the copied magnetic information, the defrauder can reproduce a duplicate card (on any plastic card) to be used later to withdraw cash.

Skimming Devices:

Pin Capturing:

- Strategically attaching / positioning cameras and other imaging devices to ATMs to fraudulently capture PIN numbers.

- Once captured, the PIN will be used to withdraw money from accounts using the reproduced duplicate card.

Pin Capturing Devices:

While individuals ranging from common citizens to police officials have been robbed of their savings through ATM frauds, here we are discussing about ATM Skimming and how cardholders can protect themselves against such frauds.

ATM Card Skimming & PIN Capturing

This is a more technical mode of duping and the cardholder can hardly do anything about it as the miscreants plant small devices for skimming and pin capturing.

|

| Skimming devices: spot the difference |

- A method used by criminals to capture data from the card.

- Devices used are smaller than a deck of cards and are often fastened in close proximity to, or over the top of the ATM’s factory-installed card reader.

- The device can read the magnetic tape information of the card when the card goes through the skimming device.

- With the copied magnetic information, the defrauder can reproduce a duplicate card (on any plastic card) to be used later to withdraw cash.

Skimming Devices:

|

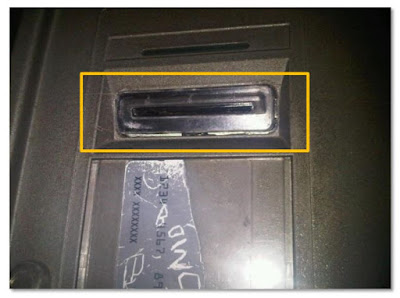

| A skimming device being ‘piggy-backed’ onto the card reader |

|

| A smaller skimmer that looks just like a normal card entry slot |

|

| Here a skimming device has been installed on the ATMs card reader |

- Strategically attaching / positioning cameras and other imaging devices to ATMs to fraudulently capture PIN numbers.

- Once captured, the PIN will be used to withdraw money from accounts using the reproduced duplicate card.

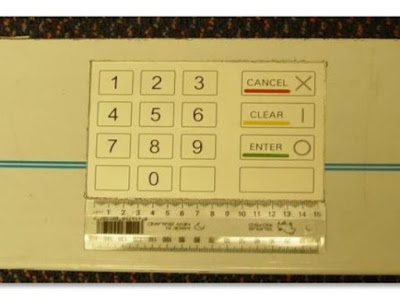

Pin Capturing Devices:

|

| A PIN capturing device fitted to the top of the ATM. |

|

| Brochure Holder - a pin-hole Camera to capture images of the keypad and PIN |

|

| An example of what an ATM skimmer plate can look like |

|

| Areas to check for any suspicious tampering |

"The customer must ensure that the card doesn’t go beyond his eyesight so that any chance of skimming is avoided," said one of the Bank official.

Another banking source said that in skimming frauds, normally the miscreants leave the skimming device planted at the machine for a few days and copy as many card details as they can and later conduct the unauthorized transactions using the cloned cards.

In the case of a skimming fraud, since the customer is not at fault and skimmers plant the device at the ATM machine, the banks generally take the liability onto themselves and refund the customer for the financial fraud. The customer, however, needs to block his card after the first instance of misuse.

How can you reduce the risk?

- Familiarize yourself with the look & feel of the ATM fascia on machines .

- Inspect the ATM & all areas of its fascia for unusual or non-standard appearance.

- Report any unusual appearance immediately to Police or the nearest bank branch.

- Always use your hand to shield your PIN when entering it.

Other Dos and Don’ts of ATM transactions

Do’s:

- Conduct your ATM transactions in complete privacy, never let anyone see you entering your Personal Identification Number (ATM Password).

- After completion of transaction ensure that welcome screen is displayed on ATM screen.

- Ensure your current mobile number is registered with the bank so that you can get alerts for all your transactions.

- Beware of suspicious movements of people around the ATM or strangers trying to engage you in conversation.

- Do check if the card given to you by the merchant after completion of the transaction is your card.

- Look for extra devices attached to the ATMs that may be put to capture your data.

- Inform the bank if the ATM / Debit card is lost or stolen and immediately report if any unauthorized transaction.

- Check the transaction alert SMSs and bank statements regularly.

Don’ts

- Do not write your PIN on the card, memorize your PIN number.

- Do not take help from strangers or handover your card to anyone for using it.

- Do not disclose your PIN to anyone, including bank employees and family members.

- Do not allow the card to go out of your sight when you are making a payment.

- Avoid speaking on the mobile phone while you are transacting.

Source & Images : Indian Express, Commonwealth Bank Of Australia

- Do not take help from strangers or handover your card to anyone for using it.

- Do not disclose your PIN to anyone, including bank employees and family members.

- Do not allow the card to go out of your sight when you are making a payment.

- Avoid speaking on the mobile phone while you are transacting.

Source & Images : Indian Express, Commonwealth Bank Of Australia